AI-Powered Forecasting: Predicting 2026 U.S. Market Hotspots for Scaleups

December 12, 2025

If you run a scaleup choosing the right U.S. market for expansion is one of your biggest strategic decisions. With 2026 approaching, the challenge is no longer finding data but making sense of it. AI-powered forecasting now gives scaleups a clear way to identify the top U.S. cities for expansion, based on real-time economic, talent, and industry signals

What Is AI-Powered Forecasting?

AI-powered forecasting uses machine learning to analyze job growth, venture capital flows, regulations, sector trends, and infrastructure investments. Instead of gut instinct, scaleups get data-driven predictions about which U.S. markets are gaining momentum.

Recent research from J.P. Morgan shows AI infrastructure investment is already adding measurable lift to U.S. GDP. Meanwhile, Vanguard highlights AI as a core productivity driver supporting 2026 growth forecasts. The 2025 Stanford AI Index reports over $250 billion in corporate AI investment — fuel for regional growth modeling.

For scaleups, this means better clarity on which cities offer talent, incentives, sector depth, and long-term upside.

Sectors Driving U.S. Growth in 2026

Forecasts point to several high-growth sectors shaping the next wave of U.S. market hotspots:

AI & Deeptech: Generative AI and automation are expected to drive sustained productivity gains nationwide.

FinTech: North America leads a global fintech market projected to exceed $300B by mid-decade.

CleanTech: The Inflation Reduction Act’s $370B in climate and energy incentives is reshaping regional growth.

Biotech & Digital Health: U.S. biotech hubs and a digital health market on track for near-trillion-dollar scale continue strong expansion.

Cybersecurity: Global spending is expected to surpass $500B around 2026 as AI-driven threats grow.

E-commerce & Retail Tech: Global ecommerce is projected to reach $6.88T by 2026 (Shopify).

Cities that specialize in these sectors are emerging as the top U.S. hotspots for scaleups .

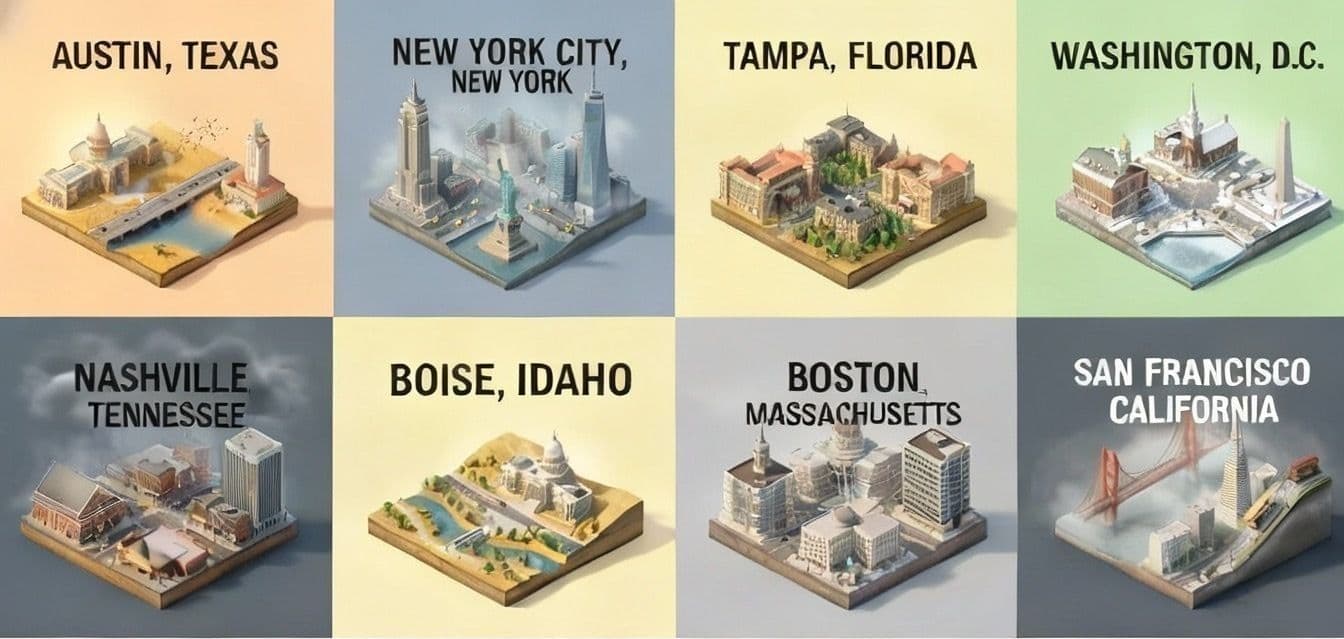

Top U.S. Hotspots for Scaleups in 2026

Austin, Texas

A leading alternative to Silicon Valley, Austin continues to attract AI, SaaS, and deeptech companies. CBRE’s tech talent reports place Austin among the strongest markets for tech workforce growth, supported by major investments from Tesla, Apple, and Oracle.

Lower taxes and strong talent make Austin ideal for scaleups seeking high growth without big-coast costs.

New York City, New York

NYC is the #2 startup ecosystem globally alongside London (Startup Genome).

Tech:NYC’s 2025 snapshot shows the city’s fintech companies have raised $46B+ in the last decade and continue to dominate U.S. fintech investment. NYC is also scaling fast in AI, climate tech, and life sciences, thanks to institutions like Columbia, NYU, Cornell Tech, and LifeSci NYC.

For fintech, biotech, AI, and enterprise SaaS scaleups, NYC offers unmatched access to customers and capital.

Raleigh–Durham, North Carolina

The Research Triangle blends world-class universities with strong biotech, software, and AI ecosystems. With lower operating costs and deep STEM talent, it’s a rising alternative to Boston and the Bay Area for deeptech and life-science scaleups.

Nashville, Tennessee

Home to 900+ healthcare companies, Nashville has become a major healthtech hub. Proximity to hospital systems and payers makes it ideal for digital health and healthcare SaaS scaleups. Lower costs and rapid population growth add to the appeal.

Tampa Bay, Florida

Tampa is a fast-growing fintech and cybersecurity hub supported by accelerators like Tampa Bay Wave, whose portfolio has raised $1B+. The region offers a strong talent pipeline, business-friendly policies, and affordability compared to Miami.

Boise, Idaho

Boise is emerging as a deeptech and semiconductor hotspot, fueled by Micron’s massive investments and Meta’s data center expansions. It combines advanced manufacturing momentum with a lower-cost, outdoor-friendly lifestyle attractive to hybrid tech teams.

San Francisco Bay Area, California

Still the global epicenter for AI, deeptech, and frontier R&D. For scaleups needing R&D talent, investor proximity, or research partnerships, Silicon Valley remains unmatched — though many now pair a small Bay Area presence with scaled operations elsewhere.

Boise, Idaho

Boston–Cambridge is the world’s leading biotech and life sciences cluster, anchored by Harvard, MIT, and top-tier hospitals. The region is also strong in robotics, AI-for-science, and medtech. Ideal for scaleups needing specialized talent and research partnerships.

How AI Helps Scaleups Choose the Right Market

Even with a shortlist, choosing between Austin, NYC, Raleigh, Tampa, or Boston is complex. AI-powered location intelligence simplifies this by analyzing:

Talent availability

Costs and wage levels

Sector specialization

Incentives and grants

Regulatory and macro risks

Platforms like Upsite.ai use AI to compare U.S. locations, identify incentives, and match cities to a scaleup’s growth profile. Upsite’s new incentive search tool lets companies explore 2,400+ U.S. incentive programs and forecast expansion outcomes using real-time data.

This turns a once guess heavy manual process into a clear, data-driven decision.

Wrapping Up

In 2026, scaleups will find major opportunities in cities like Austin, New York City, Raleigh–Durham, Nashville, Tampa, Boise, Boston, and parts of the San Francisco Bay Area. These hotspots are being shaped by AI, fintech, biotech, cleantech, cybersecurity, and e-commerce — and AI-powered forecasting makes it possible to identify them early.