For Venture Capital Firms

Give your portfolio an incentives edge.

Standardize location diligence, surface hidden value, and operationalize compliance across portcos.

Smarter Location Strategy for Venture Teams

Founders move fast, and so should your platform support. Upsite equips venture teams with AI for VC location strategy that makes early market entries and follow-on expansions easier to compare and defend. Run a consistent incentives screen for every company, from seed to growth, and understand non-dilutive funding opportunities alongside venture investment to de-risk and accelerate growth in new locations , hiring plans, and time-to-market. With Upsite’s platform, you can flag when a remote-first team should anchor in a specific state, when a hardware startup should pursue manufacturing credits, and when a services company can accelerate hiring with wage-based programs that support job creation

Get Started

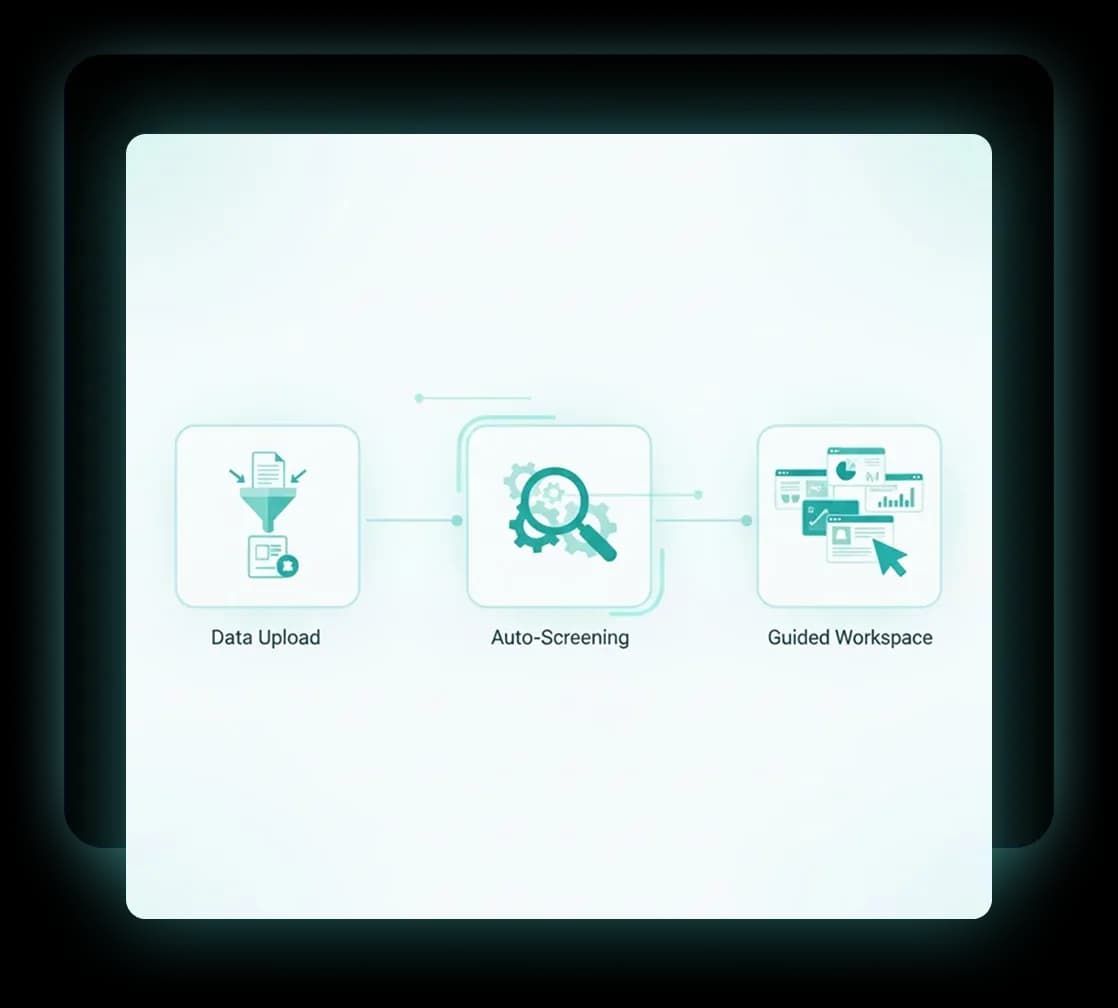

Automate Pipeline Screening and Application Prep

Upload a pipeline or connect your CRM to auto-screen target states and programs per company plan. Generate clean IC-ready summaries that translate rules into modeled outcomes, then hand founders a guided application workspace that keeps tasks, dates, and evidence straight without adding headcount. Post-close, a portfolio-level compliance calendar tracks awards and milestones across entities so nothing slips

Faster Decisions, Stronger Portfolio Outcomes

The result is faster, better-documented decisions and more captured value—without slowing down founders. Your platform team becomes the engine that spots incentives early, drives adoption, and keeps compliance on track through the next raise.